Business Experience Mr. Bunting has served as President of GB Corporation since January 2011. From 1985 until 2010, Mr. Bunting served as President and Chief Executive Officer of American KB Properties, Inc., which developed and managed shopping centers. Mr. Bunting was a director of Cornerstone Realty Income Trust, Inc., of which Glade M. Knight was Chairman and Chief Executive Officer, from 1993 until its merger with Colonial Properties Trust in 2005. He also served as a member of the Audit Committee and the Nominating and Corporate Governance Committee of the Board of Directors and has been a member of the Board of Directors since January 2015. Mr. Fosheim attended the University of South Dakota, earningBA, MBA, and JD degrees. The Board of Directors believes his extensive investment management experience and his leadership and management backgroundprovides him with the skills and qualifications to serve as a director.

Justin G. Knight. Mr. Knight, 42, has served as President of the Company since its inception and was appointed Chief Executive Officer of the Company in May 2014. Mr. Knight has also served as President of Apple REIT Ten, Inc. (“Apple Ten”) since its inception. In addition, Mr. Knight served as President of Apple REIT Seven, Inc. (“Apple Seven”) and Apple REIT Eight, Inc. (“Apple Eight”) until the mergers with the Company (the “mergers”) were completed in March 2014. Mr. Knight also served as President of Apple Hospitality Two, Inc. (“Apple Two”) until it was sold to an affiliate of ING Clarion in May 2007, as President of Apple Hospitality Five, Inc. (“Apple Five”) until it was sold to Inland American Real Estate Trust, Inc. in October 2007, and as President of Apple REIT Six, Inc. (“Apple Six”) until it merged with an affiliate of Blackstone Real Estate Partners VII in May 2013. Mr. Knight joined the Apple REIT companies in 2000. Apple Two, Apple Five, Apple Six, Apple Seven and Apple Eight were real estate investment trusts. Mr. Knight currently serves on the Board of Trustees for Southern Virginia University in Buena Vista, Virginia. Mr. Knight serves on the Marriott Owners Advisory Council, the Residence Inn Association Board, the American Hotel and Lodging Association Board of Directors and is the Co-chair of the American Hotel and Lodging Association Owners Council. Mr. Knight holds a Master of Business Administration degree with an emphasis in Corporate Strategy and Finance from the Marriott School at Brigham Young University, Provo, Utah. He also holds a Bachelor of Arts degree, Cum Laude, in Political Science from Brigham Young University, Provo, Utah. Mr. Knight serves on the Company’s Executive Committee and has been a member of the Board of Directors since January 2015. The Board of Directors believes his extensive executive experience and REIT industry and management experienceprovides him with the skills and qualifications to serve as a director.

Justin G. Knight is the son of Glade M. Knight, the Company’s Executive Chairman, and the brother of Nelson G. Knight, the Company’s Executive Vice President and Chief Investment Officer.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE NOMINEES.

Continuing Directors. The following individuals constitute the directors of the Company whose terms expire at the 2017 annual meeting of shareholders.

Glenn W. Bunting. Mr. Bunting, 71, has served as President of GB Corporation since January 2011. From 1985 until 2010, Mr. Bunting served as President of American KB Properties, Inc., which developed and managed shopping centers. Mr. Bunting was a director of Cornerstone Realty Income Trust, of which Glade M. Knight was Chairman and Chief Executive Officer, from 1993 until its merger with Colonial Properties Trust in 2005. At December 31, 2015, he was also a member of the Board of Directors of Landmark Apartment Trust of America. Mr. Bunting served as a director of Apple Two and Apple Five until the companies were sold in May 2007 and October 2007, respectively. Mr. Bunting also served as a director of Apple Eight from 2007 until the mergers with the Company were completed in March 2014. Mr. Bunting served as a director of Apple Seven from 2006 until the merger was completed in March 2014. Apple Two, Apple Five, Apple Seven, and Apple Eight were real estate investment trusts. Mr. Bunting has been a member of the Company’s Board and the Company’s Executive Committee and has served as the Chair of the Company’s Compensation Committee since March 1, 2014. Effective January 1, 2015, he is also a member of the Company’s Audit Committee. His current term will expire in 2017. Mr. Bunting received a bachelor’s degree in business administration from Campbell University. The Board of Directors believes his extensive management and REIT experience and strong background in commercial real estate and finance provide him with the skills and qualifications to serve as a director.

Glade M. Knight. Mr. Knight, 72, has served as Executive Chairman of the Company since May 15, 2014, and previously served as Chairman and Chief Executive Officer of the Company since its inception. Mr. Knight is also the founder of Apple Ten and has served as its Chairman and Chief Executive Officer since its inception. Mr. Knight was also the founder of Apple Seven

and Apple Eight (which were real estate investment trusts) and served as the Chairman and Chief Executive Officer of those companies from their inception until the mergers with the Company were completed in March 2014. In addition, Mr. Knight was the Chairman and Chief Executive Officer of Apple Six, a real estate investment trust, from 2004 until the company merged with an affiliate of Blackstone Real Estate Partners VII in May 2013. Mr. Knight served in the same capacity for Apple Five, another REIT, from 2002 until the company was sold to Inland American Real Estate Trust, Inc. in October 2007, and Apple Two, a REIT, from 2001 until it was sold to an affiliate of ING Clarion in May 2007. In addition, Mr. Knight served as Chairman and Chief Executive Officer of Cornerstone Realty Income Trust, Inc. from 1993 until it merged with a subsidiary of Colonial Properties Trust in 2005. Following the merger in 2005 until April 2011, Mr. Knight served as a trustee of Colonial Properties Trust. Cornerstone Realty Income Trust, Inc. owned and operated apartment communities in Virginia, North Carolina, South Carolina, Georgia and Texas. Mr. Knight is a partner and Chief Executive Officer of Energy 11 GP, LLC, the general partner of Energy 11, L.P., a partnership focused on investments in the oil and gas industry. Mr. Knight is the founding Chairman of Southern Virginia University in Buena Vista, Virginia. He also is a member of the Advisory Board to the Graduate School of Real Estate and Urban Land Development at Virginia Commonwealth University. Additionally, he serves on the National Advisory Council for Brigham Young University and is a founding member of the University’s Entrepreneurial Department of the Graduate School of Business Management. Mr. Knight has been a member of the Company’s Board and has served as the Chair of the Company’s Executive Committee since 2007 and his current term will expire in 2017. The Board of Directors believes his extensive REIT executive experience and extensive background in real estate, corporate finance and strategic planning, as well as his entrepreneurial background, provide him with the skills and qualifications to serve as a director. On February 12, 2014, Mr. Knight, Apple Seven, Apple Eight, Apple Nine and their related advisory companies entered into settlement agreements with the SEC. Along with Apple Seven, Apple Eight, Apple Nine and their advisory companies, and without admitting or denying the SEC’s allegations, Mr. Knight consented to the entry of an administrative order, under which Mr. Knight and the noted companies each agreed to cease and desist from committing or causing any violations of Sections 13(a), 13(b)(2)(A), 13(b)(2)(B), 14(a), and 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Rules 12b-20, 13a-1, 13a-13, 13a-14, 14a-9, and 16a-3 thereunder.

Glade M. Knight is the father of Justin G. Knight, the Company’s President and Chief Executive Officer, and Nelson G. Knight, the Company’s Executive Vice President and Chief Investment Officer.

Daryl A. Nickel. Mr. Nickel, 71, completed a 22-year career at Marriott International, Inc., an international hospitality company, in 2009. He served as a corporate officer of Marriott International from 1998 until his retirement and as Executive Vice President, Lodging Development, Select Service and Extended Stay Brands, since 2001. Since 2011, Mr. Nickel also has served as a consultant to White Peterman Properties, Inc., a hotel development company. From 2011 until July 2014, Mr. Nickel served as a consultant to Whiteco Pool Solutions, a saline pool systems company. From 2009 to 2010, Mr. Nickel served as a consultant to Apple Fund Management, Inc., currently a subsidiary of the Company. Mr. Nickel graduated from Georgetown Law School and earned his bachelor’s degree from Washburn University. Between college and law school, Mr. Nickel served in the U.S. Navy. Mr. Nickel serves on the Company’s Executive Committee, Compensation Committee and Nominating and Corporate Governance Committee and has been a member of the Board of Directors since January 2015. The Board of Directors believes his extensive consulting experience with diverse organizations and executive management positions in the lodging industry provide him with the skills and qualifications to serve as a director.

The following individuals constitute the directors of the Company whose terms expire at the 2018 annual meeting of shareholders.

Bruce H. Matson. Mr. Matson, 58, is a director of the Company and is the Chief Legal Officer of the law firm of LeClairRyan, a Professional Corporation, in Richmond, Virginia. Mr. Matson joined LeClairRyan in 1994 and has practiced law since 1983. He was also a director of

Apple Seven, a real estate investment trust, from its inception until the mergers with the Company were completed in March 2014. In addition, Mr. Matson previously served as a director of Apple Two, Apple Five and Apple Six (which were real estate investment trusts) from the inception of those companies until the companies were sold in May 2007, October 2007 and May 2013, respectively. Mr. Matson was a member of the Company’s Executive, Audit and Compensation Committees until March 1, 2014 and served as the Chair of the Company’s Compensation Committee from its inception until March 1, 2014. He is currently a member of the Executive Committee and Chair of the Nominating and Corporate Governance Committee of the Board of Directors. He has been a member of the Board of Directors since 2008. Mr. Matson graduated from the College of William and Mary, Marshall-Wythe School of Law and earned his bachelor’s degree from the College of William and Mary. The Board of Directors believes his extensive legal, commercial finance and business restructuring experience provides him with the skills and qualifications to serve as a director.

L. Hugh Redd. Mr. Redd, 58, was the Senior Vice President and Chief Financial Officer of General Dynamics Corporation, an aerospace and defense company, until December 31, 2013. He had worked for General Dynamics Corporation since 1986, serving as a Senior Financial Analyst and also as Vice President and Controller of General Dynamics Land Systems in Sterling Heights, Michigan. He received a bachelor’s degree in accounting from Brigham Young University and a master’s degree in professional accounting from the University of Texas. He also is a Certified Public Accountant. Mr. Redd serves on the Company’s Compensation Committee and as Chair of the Audit Committee and has been a member of the Board of Directors since January 2015. Mr. Redd currently serves on the Board of Trustees for Southern Virginia University in Buena Vista, Virginia. The Board of Directors believes his extensive financial and accounting experience, as well as his management experience in public companies, provide him with the skills and qualifications to serve as a director.

Proposal 2. Advisory Vote On Executive Compensation Paid by the Company

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, requires that the Company provide its shareholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers as disclosed in this proxy statement. The Company encourages shareholders to read the disclosure under “Compensation Discussion and Analysis” for more information concerning the Company’s compensation philosophy, programs and practices, the compensation and governance-related actions taken in fiscal 2015 and the compensation paid to the named executive officers. The Board of Directors has adopted a policy that provides for an annual shareholder advisory vote on the executive compensation paid by the Company.

As required by Section 14A of the Exchange Act, the Company is asking you to vote on the adoption of the following resolution:

RESOLVED: That the shareholders of the Company approve, on a nonbinding, advisory basis, the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion in the proxy statement.

The affirmative vote of a majority of the votes cast will be necessary to approve this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal. The shareholder vote on this proposal is advisory and nonbinding and serves only as a recommendation to the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL.

Proposal 3. Ratification of the Appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm

The firm of Ernst & Young LLP served as the independent registered public accounting firm for the Company in 2015. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting. The representative will have an opportunity to make a statement if he or she so desires and will be available to answer appropriate questions from shareholders. The Board of Directors has approved the retention of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2016, based on the recommendation of the Audit Committee. Independent accounting fees for the last two fiscal years are shown in the table below:

| Year | | Audit Fees | | | Audit-Related Fees | | | Tax Fees | | | All Other Fees | | | 2015 | | $ | 908,000 | | | | — | | | | — | | | | — | | | 2014 | | $ | 1,017,000 | | | | — | | | | — | | | | — | |

All services rendered by Ernst & Young LLP are permissible under applicable laws and regulations, and the annual audit of the Company was pre-approved by the Audit Committee, as required by applicable law. The nature of each of the services categorized in the preceding table is described below:

Audit Fees. These are fees for professional services rendered for the audit of the Company’s annual financial statements included in the Company’s Form 10-K, reviews of the financial statements included in the Company’s Form 10-Q filings or services normally provided by the independent auditor in connection with statutory or regulatory filings or engagements and other accounting and financial reporting work necessary to comply with the standards of the Public Company Accounting Oversight Board (“PCAOB”) and fees for services that only the Company’s independent auditor can reasonably provide.

Audit-Related Fees. These are fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements. Such services include accounting consultations, internal control reviews, audits in connection with acquisitions, attest services related to financial reporting that are not required by statute or regulation and required agreed-upon procedure engagements.

Tax Fees. Such services include tax compliance, tax advice and tax planning.

All Other Fees. These are fees for other permissible work that does not meet the above category descriptions. Such services include information technology and technical assistance provided to the Company. Generally, this category would include permitted corporate finance assistance, advisory services and licenses to technical accounting research software.

These accounting services are actively monitored (as to both spending level and work content) by the Audit Committee to maintain the appropriate objectivity and independence in the core area of accounting work by Ernst & Young LLP, which is the audit of the Company’s consolidated financial statements.

Pre-Approval Policy for Audit and Non-Audit Services. In accordance with the Sarbanes-Oxley Act of 2002, all audit and non-audit services provided to the Company by its independent auditors must be pre-approved by the Audit Committee. As authorized by that act, the Audit Committee has delegated to the Chair of the Audit Committee the authority to pre-approve up to $25,000 in audit and non-audit services. This authority may be exercised when the Audit Committee is not in session. Any decisions by the Chair of the Audit Committee under this delegated authority will be reported at the next meeting of the Audit Committee. All services reported in the preceding fee table for fiscal years 2014 and 2015 were pre-approved by the full Audit Committee, as required by then applicable law.

The Company is asking you to vote on the adoption of the following resolution:

RESOLVED: That the shareholders of the Company ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016.

The affirmative vote of a majority of the votes cast will be necessary to approve this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal. The shareholder vote on this proposal is advisory and nonbinding and serves only as a recommendation to the Board of Directors. If the shareholders do not ratify the appointment of Ernst & Young LLP by the affirmative vote of a majority of the votes cast at the meeting, the Audit Committee will reconsider whether or not to retain Ernst & Young LLP.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL.

Proposal 4. Approval and Adoption of Amended and Restated Articles of Incorporation

The Board of Directors, in its continuing review of corporate governance matters, and after careful consideration, has concluded that it is in the best interests of the Company’s shareholders to amend and restate the Charter, to (1) declassify the Board of Directors, (2) require a majority vote for all amendments to the Charter, (3) eliminate certain supermajority voting default rules for affiliated transactions and (4) remove certain provisions that are no longer applicable, as more fully described below. The overall goal of these amendments is to enhance the rights of shareholders, improve the Company’s corporate governance and simplify the Charter.

The proposed Charter amendments are being submitted for approval through four separate proposals—Proposal 4.1, Proposal 4.2, Proposal 4.3 and Proposal 4.4. Under the Company’s current Charter, the proposed amendment included in Proposal 4.1 must be approved by the affirmative vote of more than two-thirds of the issued and outstanding Common Shares. The proposed amendments included in Proposals 4.2 and 4.4 must be approved by the affirmative vote of a majority of the issued and outstanding Common Shares. With respect to Proposal 4.3, under the Virginia Stock Corporation Act (the “VSCA”), shares that are owned by interested shareholders (if any) are not entitled to vote with respect to this amendment. Therefore, the affirmative vote of a majority of the shares of the shareholders of the Company (other than shares held by interested shareholders) is required to approve the proposed amendment in Proposal 4.3.

A copy of the proposed Amended and Restated Articles of Incorporation (the “Amended and Restated Charter”) is attached to this proxy statement as Exhibit A, with deletions indicated by strikethroughs and additions indicated by underlining (with such marks against our existing Charter). In addition to effecting the proposed amendments to our existing Charter described above, the proposed Amended and Restated Charter would restate and integrate into a single document all prior amendments to the Company’s articles of incorporation, which was filed with the Virginia State Corporation Commission in November 2007 and became effective in April 2008. These prior amendments, which occurred in March 2014, include:

· | A change in the Company’s name to “Apple Hospitality REIT, Inc.”; |

· | An increase in the number of authorized common shares from 400 million to 800 million; |

· | The addition of a new Section 8.3 permitting shareholders or the board to amend the Company’s bylaws; and |

· | The addition of a new Article X regarding restrictions on transfer and ownership of common shares to protect the Company’s tax status. |

The proposed Charter amendments are summarized in Proposals 4.1, 4.2, 4.3 and 4.4 below. To the extent approved by the shareholders, the Company will implement these amendments through the adoption of the Amended and Restated Charter, which would become effective upon filing with, and acceptance for record by, the Virginia State Corporation Commission. The summaries of the proposed amendments set forth in Proposals 4.1, 4.2, 4.3 and 4.4 below are qualified in their entirety by reference to Exhibit A, which you should read in its entirety. In the summaries, article and section references are to the articles and sections of the current Charter unless otherwise noted.

Approval by shareholders of any of the above-referenced proposals will result in the filing of the Amended and Restated Charter with the Virginia State Corporation Commission promptly after the Annual Meeting. If shareholders approve some but not all of the above-referenced proposals, the Company will file the Amended and Restated Charter containing only the amendments referenced in the proposals that were approved.

Proposal 4.1. Amendment to the Charter to Declassify the Board and Provide for Annual Elections of Directors

Article VII of the Charter provides that the Board is classified into three groups, with each group of directors serving a staggered term, so that the term of only one class expires at each annual meeting of shareholders and each class is elected to a three-year term.

The Board has proposed that Article VII of the Charter be revised to declassify the Board. Specifically, under the proposed amendment to the Charter:

· | all directors elected or appointed at or after the Annual Meeting will serve for terms expiring at the next annual meeting of shareholders, so that, beginning at the 2018 annual meeting of shareholders, the Board of Directors will no longer be dividedof Landmark Apartment Trust of America until 2016 when it merged with and into classesan affiliate of Starwood Capital Group. Mr. Bunting served as a director of Apple Two, Apple Five, Apple Seven and all directors will be electedApple Eight until the companies were sold to a third party or merged with the Company, as described in Note 1 below. Mr. Bunting received a Bachelor of Business Administration degree from Campbell University. The Board of Directors believes his extensive management and REIT experience and strong background in commercial real estate, investment, strategic planning, risk management and finance provide him with the skills and qualifications to serve for terms expiring at the next annual meeting of shareholders; |

· | all directors currently in office whose terms expire at the 2017 and 2018 annual meetings of shareholders will continue to serve their remaining terms; and |

· | any director chosen as a resultdirector. |

| | |

| Jon A. Fosheim |

| Lead Independent Director Director Since: 2015 Age: 73 | Committees: •Nominating and Corporate Governance |

|

|

| Business Experience Mr. Fosheim was the Chief Executive Officer of Oak Hill REIT Management, LLC from 2005 until his retirement in 2011. Oak Hill REIT Management, LLC is a newly created directorship orhedge fund specializing in REIT investments. From 1985 until 2005, Mr. Fosheim was a Principal and Co-founder of Green Street, a real estate analytics firm. Prior to fillthat, Mr. Fosheim worked in institutional sales at Bear Stearns & Co., a vacancyglobal investment bank, and worked in the tax department at Touche Ross and Co. (now Deloitte LLP), an international accounting firm. Mr. Fosheim currently serves on the Board afterof Directors of DigitalBridge Group, Inc., formerly Colony Capital, Inc., and serves on the Annual Meeting will hold office for a term expiring atAudit Committee and the next annual meetingCompensation Committee of shareholders. |

The purpose of this amendment is to declassify the Board of Directors and provide that each director serves for a one year term in order to bring the Company’s governance structure into line with shareholder-favorable market practice, thereby enhancing the rights of shareholders and improving the Company’s corporate governance to maximize accountability to shareholders. The Board of Directors considered the benefits of classified boards, which may foster stability and continuity of the board with respect to long-term planning and in the overall business of a company, since a majority of directors would always have prior experience as directors of the company. Moreover, classified boards provide non-management directors with a longer term of office that may enhance their independence from management. However, the election of directors is the primary means for shareholders to exercise influence over the Company and its policies. The Board of Directors believes that classified boards are often viewed as having the effect of reducing the accountability of directors to a company’s shareholders. A classified board limits the ability of shareholders to elect all directors on an annual basis and may discourage proxy contests in which shareholders have an opportunity to vote for a competing slate of nominees. Moreover, unsolicited tender offers for shares are sometimes accompanied by proxy contests. Declassifying the Board could therefore make it more likely that a potential acquiror may offer shareholders a control premium for their shares. However, if the amendment is approved, the entire Board could be removed in any single year, which could make it more difficult to discourage persons from engaging in proxy contests or otherwise seeking control of the Company on terms that the then-incumbent Board does not believe are in the best interest of shareholders. While classified boards may increase the long-term stability and continuity of a board, the Board of Directors believes that long-term stability and continuity should result from the annual election of directors, which provides shareholders with the opportunity to evaluate the directors’ performance, both individually and collectively, on an annual basis.

If this Proposal 4.1 is approved by the shareholders at the Annual Meeting, the two director nominees standing for election at the Annual Meeting would each stand for election for a one-year term expiring at the 2017 annual meeting of shareholders. If shareholders do not approve this Proposal 4.1, the directors of the Company will continue to be elected in three staggered classes with three-year terms, including the two director nominees standing for election at the Annual Meeting, who would each stand for election for a three-year term expiring at the 2019 annual meeting of shareholders.

The affirmative vote of more than two-thirds of the issued and outstanding Common Shares will be necessary to approve this proposal. Therefore, abstentions and broker non-votes will have the same effect as votes against the proposal, although abstentions and broker non-votes will count toward the presence of a quorum.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL.

Proposal 4.2. Amendment to the Charter to Require a Majority Vote for all Charter Amendments

Section 8.1 of the Charter provides that, except as required by law or the rights of any series of preferred shares of the Company, the Charter may be amended by the vote of a majority of the issued and outstanding Common Shares; provided, that the vote of more than two-thirds of the issued and outstanding Common Shares is required to amend Article VII. Article VII of the Charter sets forth the provisions that classify the current Board. In Proposal 4.1, an amendment of Article VII to declassify the Board is being submitted to shareholders.

The Board of Directors has proposed that Section 8.1 of the Charter be revised so that the Charter may be amended in any respect by the vote of a majority of the issued and outstanding Common Shares, except as required by law or rights of any series of preferred shares of the Company. The Board believes that this amendment will give the Company more flexibility and enhance the rights of shareholders and the Company’s corporate governance practices.

The affirmative vote of a majority of the issued and outstanding Common Shares will be necessary to approve this proposal. Therefore, abstentions and broker non-votes will have the same effect as votes against the proposal, although abstentions and broker non-votes will count toward the presence of a quorum.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL.

Proposal 4.3. Amendment to the Charter to Eliminate the Supermajority Voting Requirement for Affiliated Transactions

The VSCA contains provisions designed to deter certain takeovers of Virginia corporations. Article 14 of the VSCA contains the “affiliated transaction” provisions of Virginia law that prohibit any person who becomes the beneficial owner of more than 10% of any class of a corporation’s voting securities (an “interested shareholder”) from engaging in specified transactions with such corporation for a period of three years following the date upon which the shareholder acquires the requisite number of securities without the approval of (i) a majority (but not less than two) of the corporation’s disinterested directors and (ii) two-thirds of the voting shares of the corporation, other than shares owned by the interested shareholder, subject to certain exceptions. The types of transactions covered by the law include certain mergers, share exchanges, material dispositions of corporate assets not in the ordinary course of business, dissolutions, reclassifications and recapitalizations. These provisions may have the effect of deterring a change in control.

The Charter is currently silent as to the level of shareholder approval for affiliated transactions with interested shareholders. Under Virginia law, when a charter is silent in respect of these transactions, a two-thirds shareholder approval is required in order to effect an affiliated transaction.

Virginia law, however, allows corporations to elect to not to be governed by Article 14 of the VSCA. Accordingly, the Board has approved and recommends for approval by the Company’s shareholders an amendment to the Charter to add a new Article XI that provides that the Company has opted out of Article 14 of the VSCA. If the shareholders approve this Proposal 4.3, affiliated transactions that involve entry into a plan of merger, a share exchange or dissolution, or the sale, lease, exchange or other disposition of all or substantially all of the Company’s property other than in the regular course of business would require the affirmative vote of the majority of the issued and outstanding Common Shares and a majority of the votes entitled to be voted by any other voting group required by law to vote thereon, pursuant to Section 8.2 of the Charter.

The Company is not proposing this amendment to the Charter in response to any pending, planned or contemplated transaction.

The affirmative vote of a majority of the issued and outstanding Common Shares other than Common Shares owned by an interested shareholder will be necessary to approve this proposal. Abstentions and broker non-votes will have the same effect as votes against the proposal, although abstentions and broker non-votes will count toward the presence of a quorum.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL.

Proposal 4.4. Amendments to the Charter to Eliminate Provisions that are no Longer Applicable

In addition to the amendments reflected in Proposals 4.1, 4.2 and 4.3, the Amended and Restated Charter deletes sections of the Charter that are no longer applicable and reduces the number of authorized preferred shares to reflect the prior retirement of the preferred shares in connection with the mergers.

Elimination of Inapplicable Provisions. The Amended and Restated Charter deletes the following sections of the Charter that are no longer applicable:

· | Article IVA – Reclassificationsuch board. Mr. Fosheim attended the University of Common Shares Upon Listing —South Dakota, earning Bachelor of Arts, Master of Business Administration, and Juris Doctor degrees. The AmendedBoard of Directors believes his extensive investment management, finance, strategic planning, ESG, risk management and Restated Charter deletes this article which was used to effect the Company’s 2015 reverse share split in connectionREIT experience and his leadership and management background provide him with the Listing,skills and qualifications to serve as a director.

|

| | |

|

| 15 |

| | |

| Kristian M. Gathright |

| Director Since: 2019 Age: 51 |

|

|

|

| Business Experience Ms. Gathright served as Executive Vice President and Chief Operating Officer for the Company from its inception until her retirement on March 31, 2020. In addition, Ms. Gathright held various senior management positions with each of the Apple REIT Companies from inception until they were sold to a third party or merged with the Company, as described above under “Recent Changes in the Company’s Shareholder Base”. These provisions were no longer necessary once the reverse share split was consummatedNote 1 below. Prior to her service with these companies, Ms. Gathright served as Assistant Vice President and Investor Relations Manager for Cornerstone Realty Income Trust, Inc., a REIT that owned and operated apartment communities in May 2015Virginia, North Carolina, South Carolina, Georgia and therefore their removal would have no impact on shareholders. |

· | Article V – Preferred Shares — The AmendedTexas. She also worked as an Asset Manager and Restated Charter deletes the provisions of Article V that set the termsRegional Controller of the Company’s Series A Preferred SharesNorthern Region Operations for United Dominion Realty Trust, Inc., a REIT, and Series B Convertible Preferred Shares. Neither of these series of preferred shares are outstanding at this time and the Company cannot reissue these series of preferred shares in the future. The Amended and Restated Charter retains and does not alterbegan her career with Ernst & Young LLP. Ms. Gathright served on the Board of Directors’ rightDirectors of Spirit Realty Capital, Inc. from 2021 until its merger with Realty Income, Inc. in January 2024. She served on the Nominating and Corporate Governance Committee and Compensation Committee of such board. Ms. Gathright joined Derive Ventures as an advisor in 2022. Ms. Gathright previously served on the Board of Directors of the American Hotel & Lodging Association and as President of the Courtyard Franchise Advisory Council. Ms. Gathright currently serves on the University of Virginia Foundation Board of Directors and the McIntire School of Commerce Foundation Board of Trustees. Ms. Gathright holds a Bachelor of Science degree, Graduate with Distinction, in Accounting from the McIntire School of Commerce at the University of Virginia, Charlottesville, Virginia. The Board of Directors believes her extensive hotel industry and real estate experience and her background in finance, investment, strategic planning, risk management, leadership and management provide her with the skills and qualifications to setserve as a director.

|

| | |

|

| 16 |

| | |

| Carolyn B. Handlon |

| Director Since: 2023 Age: 66 | Committees: •Nominating and Corporate Governance |

|

|

| Business Experience Ms. Handlon served as the preferences, limitationsExecutive Vice President, Finance and relative rights, withinGlobal Treasurer, of Marriott International, Inc. (“Marriott”) for more than 17 years until her retirement in April 2022, overseeing the limits set forthfinancial health and strategy, global investments, and capital markets for Marriott. Ms. Handlon joined Marriott in 1987 as Corporate Finance Manager and held various positions of increasing seniority and responsibility during her tenure with the company. During her 35 years of leadership experience with Marriott, Ms. Handlon’s areas of responsibility spanned global capital markets, global investment, real estate lending, corporate financial strategy and financial risk management. Instrumental in Marriott’s growth, Ms. Handlon was a key leader in strategic transformations, including the creation of Marriott’s asset-light business models, company spin-offs, and mergers and acquisitions. Prior to joining Marriott, Ms. Handlon worked for the Overseas Private Investment Corporation and for the Continental Illinois National Bank and Trust. Ms. Handlon currently serves on the Board of Directors for Invesco Mortgage Capital Inc. and on the Compensation Committee, the Nomination and Corporate Governance Committee, and as chair of the Audit Committee of such board. Ms. Handlon also serves on the Board of Directors for Science Applications International Corporation and on the Audit Committee and Nominating and Corporate Governance Committee of such board. Ms. Handlon is a member of the Economic Club of Washington, D.C., the National Association of Corporate Directors and Women Corporate Directors. Ms. Handlon holds a Bachelor of Arts degree from Virginia Polytechnic Institute and State University and a Master of Business Administration degree from Indiana University. Ms. Handlon also holds a Corporate Board Certificate from Harvard Business School. The Board of Directors believes her extensive 40-year background in the VSCA,financial and global markets and real estate industries along with senior leadership, investment, strategic planning, risk management and hotel industry experience provide her with the skills and qualifications to serve as a director. |

| | |

|

| 17 |

| | |

| Glade M. Knight |

| Executive Chairman Director Since: 2007 Age: 80 | Committees: |

|

|

| Business Experience Mr. Knight is the founder of any new seriesthe Company and has served as Executive Chairman since May 2014, and previously served as Chairman and Chief Executive Officer of preferred shares without shareholder approval. |

· | Section 9.1 – Definitions — The Amendedthe Company since its inception. Mr. Knight was also the founder of each of the Apple REIT Companies and Restated Charter deletes certain defined terms thatserved as their Chairman and Chief Executive Officer from their inception until the companies were sold to a third party or merged with the Company, as described in Note 1 below. In addition, Mr. Knight served as Chairman and Chief Executive Officer of Cornerstone Realty Income Trust, Inc., a REIT, from 1993 until it merged with Colonial Properties Trust, a REIT, in 2005. Following the merger in 2005 until April 2011, Mr. Knight served as a trustee of Colonial Properties Trust. Cornerstone Realty Income Trust, Inc. owned and operated apartment communities in Virginia, North Carolina, South Carolina, Georgia and Texas. Mr. Knight is a partner and the Chief Executive Officer of Energy 11 GP, LLC, and Energy Resources 12 GP, LLC, which are not usedthe respective general partners of Energy 11, L.P. and Energy Resources 12, L.P., partnerships focused on investments in the Amendedoil and Restated Charter.gas industry. Mr. Knight is the founding Chairman of Southern Virginia University in Buena Vista, Virginia. Additionally, he is a founding member of Brigham Young University’s Entrepreneurial Department of the Graduate School of Business Management. The Board of Directors believes his extensive REIT executive experience and extensive background in real estate, the hotel industry, investment, corporate finance, risk management and strategic planning, as well as his entrepreneurial background, provide him with the skills and qualifications to serve as a director.

Glade M. Knight is the father of Justin G. Knight, the Company’s Chief Executive Officer, and Nelson G. Knight, the Company’s President, Real Estate and Investments. |

| | |

| Justin G. Knight |

| Chief Executive Officer Director Since: 2015 Age: 50 | Committees: |

|

|

| Business Experience Mr. Knight has served as Chief Executive Officer of the Company since May 2014 and served as President of the Company from its inception through March 2020. Mr. Knight also served as President of each of the Apple REIT Companies, except Apple Suites, until they were sold to a third party or merged with the Company, as described in Note 1 below. Mr. Knight joined the Apple REIT Companies in 2000 and held various senior management positions prior to his appointment as President. Mr. Knight currently serves on the Marriott Owners Advisory Council, as President of the Residence Inn Association Board, and as an Owner Representative to the Executive Committee and a member of the Owner Leader Council of the American Hotel & Lodging Association (AHLA). From 2014 to 2023, Mr. Knight served as a member of the AHLA Board of Directors and acted as Chair of such board in 2022. Mr. Knight is also a member of the National Advisory Council of the Marriott School at Brigham Young University, Provo, Utah. Mr. Knight holds a Master of Business Administration degree with an emphasis in Corporate Strategy and Finance from the Marriott School at Brigham Young University. He also holds a Bachelor of Arts degree, Cum Laude, in Political Science from Brigham Young University. The Board of Directors believes his extensive executive experience and REIT industry, hotel industry, risk management, strategic planning, investment, finance and management experience provide him with the skills and qualifications to serve as a director.

Justin G. Knight is the son of Glade M. Knight, the Company’s Executive Chairman, and the brother of Nelson G. Knight, the Company’s President, Real Estate and Investments. |

| | |

|

| 18 |

| | |

| Blythe J. McGarvie |

| Director Since: 2018 Age: 67 | Committees: •Nominating and Corporate Governance (Chair)

|

|

|

| Business Experience Ms. McGarvie was a member of the faculty of Harvard Business School, teaching Financial Reporting and Controls on a full-time basis from July 2012 to June 2014. Ms. McGarvie served as Chief Executive Officer and Founder of Leadership for International Finance, LLC, an advisory firm offering consulting services and providing leadership seminars, from 2003 to 2012, where she offered strategic reviews and leadership seminars for improved decision-making for corporate and academic groups. From 1999 to 2002, Ms. McGarvie was the Executive Vice President and Chief Financial Officer of BIC Group, a publicly traded consumer goods company with operations in 36 countries. Prior to that, Ms. McGarvie served as Senior Vice President and Chief Financial Officer of Hannaford Bros. Co., a Fortune 500 retailer, and Chief Administrative Officer of Sara Lee Corporation for the Pacific Rim. Ms. McGarvie currently serves on the boards of directors of LKQ Corporation (“LKQ”) (since 2012), Sonoco Products Company (“Sonoco”) (since 2014), Cineworld PLC (since 2023) and Wawa, Inc. (since 1998). She serves as chair of the Audit Committee and a member of the Governance/Nominating Committee for LKQ, as chair of the Financial Policy Committee and a member of the Audit Committee and Employee and Public Responsibility Committee for Sonoco and as chair of the Audit Committee and a member of the Nominating/Governance Committee for Cineworld PLC. Ms. McGarvie previously served on the boards of directors of Accenture plc, Viacom Inc., Pepsi Bottling Group, Inc., The Travelers Companies, Inc. and Lafarge North America. Ms. McGarvie is a Certified Public Accountant and holds a Bachelor of Arts degree in Economics from Northwestern University, Evanston, Illinois, and a Master of Business Administration from Northwestern University’s J.L. Kellogg Graduate School of Management. The Board of Directors believes her extensive experience serving on a wide range of boards, as well as her strong finance, accounting, strategic planning, ESG, and risk management background and entrepreneurial success provide her with the skills and qualifications to serve as a director. |

| | |

| L. Hugh Redd |

| Director Since: 2015 Age: 66 | Committees:

|

|

|

| Business Experience Mr. Redd was the Senior Vice President and Chief Financial Officer of General Dynamics Corporation, an aerospace and defense company, until December 2013. He had worked for General Dynamics Corporation since 1986, serving as a Senior Financial Analyst and also as Vice President and Controller of General Dynamics Land Systems in Sterling Heights, Michigan. He received a Bachelor of Science degree in Accounting from Brigham Young University and a Master in Professional Accounting degree from the University of Texas. He is also a Certified Public Accountant. Mr. Redd currently serves as Chairman of the Board of Trustees for Southern Virginia University in Buena Vista, Virginia. The Board of Directors believes his extensive financial and accounting experience, as well as his strategic planning, risk management and public company management experience, provide him with the skills and qualifications to serve as a director. |

The deletion

| | |

|

| 19 |

| | |

| Howard E. Woolley |

| Director Since: 2021 Age: 66 | Committees: •Nominating and Corporate Governance

|

|

|

| Business Experience Mr. Woolley has served as President and Chief Executive Officer of Howard Woolley Group, LLC, a government relations, public policy and regulatory risk advisory firm serving large technology and wireless industry corporations, since 2015. His firm has also provided diversity, equity, and inclusion advice to clients. Prior to founding Howard Woolley Group, LLC, Mr. Woolley served as Senior Vice President Wireless Policy and Strategic Alliances for Verizon Communications Inc. (“Verizon”). During his tenure at Verizon, Mr. Woolley led the federal and state government relations for Verizon Wireless which contributed to the company’s growth and expansion. He advised all CEOs of Verizon Wireless on public policy from the company’s founding in 2000 until his retirement in 2013. From 1981 until 1993, Mr. Woolley served in various congressional affairs and regulatory public policy positions ultimately rising to the position of Vice President, Regulatory Affairs, with the National Association of Broadcasters. Mr. Woolley currently serves as the Lead Independent Director on the Board of Directors for Somos, Inc., a telecommunications registry management and data solutions company, and serves on the Executive Committee, the Nominating and Governance Committee and as chair of the Compensation Committee of such board. Mr. Woolley also serves on the Allianz Life Insurance Company of North America Board of Directors where he is a member of the Audit Committee and the Nomination, Evaluation and Compensation Committee. Mr. Woolley also serves on the Board of Directors for the Allianz Life Insurance Company of New York. Mr. Woolley serves on the Board of Trustees for Johns Hopkins University and the Board of Trustees for Johns Hopkins Medicine and the Executive Committee of such board, and co-chairs the Johns Hopkins University and Medicine External Affairs and Community Engagement Committee. Mr. Woolley is on the Board of Trustees for Syracuse University and serves on the Audit and Risk, Academic Affairs and Executive Committees for such board. Beginning in 2010, Mr. Woolley served on the boards of leading civil rights organizations including the National Urban League. Mr. Woolley holds a Bachelor of Science degree from the S.I. Newhouse School of Public Communications at Syracuse University and a Master of Administrative Sciences degree in business from Johns Hopkins University. Mr. Woolley is a National Association of Corporate Directors Governance Fellow. He is frequently asked to participate as a panelist on board leadership topics for organizations such as the Executive Leadership Council. The Board of Directors believes his extensive leadership and governance experience, as well as his experience in strategic planning, ESG, public policy, regulatory, risk management and government affairs, provide him with the skills and qualifications to serve as a director. |

(1)Below are the “Apple REIT Companies” that were sold to a third party or merged with the Company. All of the reverse share split, termsApple REIT Companies, founded by Glade M. Knight, were REITs with ownership of the preferred shares and the definitions are intended to simplify the Amended and Restated Charter by removing now-irrelevant provisions.

Reduction in Authorized Preferred Shares. The Amended and Restated Charter also reduces the authorized number of preferred shares from 430,480,000 to 30,000,000. The Company previously issued an aggregate of 400,000,000 Series A Preferred Shares and 480,000 Series B Convertible Preferred Shares, which are no longer outstanding and are not available for reissuance. The Company believes the reduction in the preferred shares is necessary to accurately reflect the current number of preferred shares available for issuance by the Company in the future.

As described above, the Amended and Restated Charter will consolidate into a single document the original articles of incorporation and the prior amendments thereto as applicable.

The affirmative vote of a majority of the issued and outstanding Common Shares will be necessary to approve this proposal. Therefore, abstentions and broker non-votes will have the same effect as votes against the proposal, although abstentions and broker non-votes will count toward the presence of a quorum.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL.

16

primarily rooms-focused hotels.

| | | | | Company |

| FormationDate |

| Sale/Merger Description | Apple Suites, Inc. (“Apple Suites”) |

| 1999 |

| Merged with Apple Hospitality Two, Inc. in January 2003 | Apple Hospitality Two, Inc. (“Apple Two”) |

| 2001 |

| Sold to an affiliate of ING Clarion in May 2007 | Apple Hospitality Five, Inc. (“Apple Five”) |

| 2002 |

| Sold to Inland American Real Estate Trust, Inc. in October 2007 | Apple REIT Six, Inc. (“Apple Six”) |

| 2004 |

| Sold to an affiliate of Blackstone Real Estate Partners VII in May 2013 | Apple REIT Seven, Inc. (“Apple Seven”) |

| 2005 |

| Merged with the Company in March 2014 | Apple REIT Eight, Inc. (“Apple Eight”) |

| 2007 |

| Merged with the Company in March 2014 | Apple REIT Nine, Inc. (“Apple Nine”) |

| 2007 |

| Original name of the Company. Name changed to Apple Hospitality REIT, Inc. in March 2014 | Apple REIT Ten, Inc. (“Apple Ten”) |

| 2010 |

| Merged with the Company in September 2016 |

Corporate Governance, Risk Oversight and Procedures for Shareholder Communications

| | |

|

| 20 |

CORPORATE GOVERNANCE Board of Directors . The Company’s Board of Directors has determined that all of the Company’s directors (and nominees for director), except Messrs. Glade M. Knight and Justin G. Knight, are “independent” within the meaning of the rules of the NYSE.New York Stock Exchange (“NYSE”). Due to her previous employment by the Company, Kristian M. Gathright was not considered independent within the meaning of the rules of the NYSE until October 2023. In making this determination, the Board considered all relationships between the applicable director and the Company, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships.The Board has adopted a categorical standard that a director is not independent (a) if he or she receives any personal financial benefit from, on account of or in connection with a relationship between the Company and the director (excluding directors’ fees and equity-based awards); (b) if he or she is a partner, officer, employee or managing member of an entity that has a business or professional relationship with, and that receives compensation from, the Company; or (c) if he or she is a non-managing member or shareholder of such an entity and owns 10% or more of the membership interests or common stock of that entity. The Board may determine that a director with a business or other relationship that does not fit within the categorical standard described in the immediately preceding sentence is nonetheless independent, but in that event, the Board is required to disclose the basis for its determination in the Company’s then current annual proxy statement. Proxy Statement.In order to optimize the effectiveness and independence of the Board, the independent directors have designated an independent, non-employee director to serve as the Company’s Lead Independent Director, which currently is held by Jon A. Fosheim. See “Committees of the Board and Board Leadership.” Code of Ethics . The Board has adopted a Code of Business Conduct and Ethics for the Company’s officers, directors and employees, which is available at the Company’s website, www.applehospitalityreit.com.www.applehospitalityreit.com. The purpose of the Code of Business Conduct and Ethics is to promote (a) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest; (b) full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by the Company; and (c) compliance with all applicable rules and regulations that apply to the Company and its officers, directors and employees. Any waiver of the Code of Business Conduct and Ethics for the Company’s executive officers or Board may be made only by the Board or one of the Board’s committees. The Company anticipates that any waivers of the Code of Business Conduct and Ethics will be posted on the Company’s website. Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines that set forth the guidelines and principles for the conduct of the Board of Directors, which is available at the Company’s website, www.applehospitalityreit.com. The Corporate Governance Guidelines reflect the Board of Directors’ commitment to monitoring the effectiveness of decision-making at the Board and management level and ensuring adherence to good corporate governance principles, all with a goal of enhancing shareholder value over the long term. Risk Oversight. The Board believes that risk oversight is a key function of a Boardboard of Directors.directors. It administers its oversight responsibilities through its Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee. All members of each of these committees are independent directors. The entire Board is kept abreast of and involved in the Company’s risk oversight process. It is through the approval of officers and compensation plans, andas well as management updates on property performance, industry performance, financing strategy, acquisitions and dispositions strategy and capital improvements, that the Board has input to manage the Company’s various risks. Additionally, through the Audit Committee, the Board reviews management’s and independent auditors’ reports on the Company’s internal controls and any associated potential risks of fraudulent activities. Throughactivities as well as risks related to cybersecurity. In 2022, the Nominating and CorporateBoard approved changes to the Charter of the Governance Committee to formalize the Governance Committee’s role in reviewing the Company’s policies, programs and practices related to corporate responsibility and sustainability and climate-related risks and opportunities. In 2023, the Board reviewsapproved amendments to the Company’s Corporate Governance Guidelines andCharter of the Audit Committee to formally expand the Audit Committee’s oversight of risk management policies to include those related risks.to cybersecurity. Through the Compensation Committee, the Board oversees risk related to compensation practices with the objective of balancing risk/rewards to overall business strategy.strategy, including the Company’s corporate responsibility initiatives. Risk oversight is also one of the factors considered by the Board in

| | |

|

| 21 |

establishing its leadership structure. The Company has separated the roles of Executive Chairman and Chief Executive Officer to create a leadership structure that the Board believes strikes the appropriate balance between the authority of those who oversee the Company and those who manage it on a day-to-day basis.basis and also has a Lead Independent Director to optimize the effectiveness and independence of the Board. Shareholder Communications. The Company and the Board value the views and opinions of the Company’s shareholders and believe strong corporate governance practices demand consistent outreach, effective communication and regular engagement with shareholders. Regular shareholder engagement better positions the Company to: •understand which issues are most important to its shareholders and provide relevant information; •provide transparency related to its business, operations, strategies, governance and compensation; Shareholder Communications.•recognize expectations for future performance; •identify emerging issues that may affect its business, operations, strategies, governance or compensation; and •obtain valuable feedback for its business and the lodging industry in general. The Company’s shareholder and investor interaction includes the Company’s annual meeting of shareholders, industry conferences, analyst meetings, investor road shows, property tours and individual meetings, both in person and virtually. The Company also provides information to stakeholders through its website, quarterly earnings calls, SEC filings, Proxy Statement, news releases, investor presentations and other communication channels. Shareholders and other interested parties may send communications to the Board or to specified individual directors. Any such shareholder communications should be directed to Ms. Kelly Clarke, Investor Services Department (as described in a preceding section of this proxy statement entitled “Company Information”). Such communications receive an initial evaluation to determine, based on the substance and natureattention of the Lead Independent Director at Apple Hospitality REIT, Inc., 814 East Main Street, Richmond, Virginia 23219. The Lead Independent Director will decide what action should be taken with respect to the communication, a suitable process for internal distribution, review and response or other appropriate treatment. including whether such communication should be reported to the full Board.Share Ownership Guidelines .Guidelines.The Board believes that equity ownership by directors and executive officers canwill align their interests with shareholders’ interests. To that end, on February 11, 2016, the Company has adopted formal share ownership guidelines, included in the Company’s Corporate Governance Guidelines, applicable to all of its directors and executive officers. On an annual basis, the Company evaluates the ownership status of the directors and executive officers. The share ownership guidelines with respect to directors require directors Directors and executive officers are required to own securities of the Company with a value equal in value to at least two times the following multiple of their annual base cash retainer. Currentretainer (for directors) or their annual base salary (for executive officers):

| | Directors | 4x | Chief Executive Officer | 5x | Other executive officers | 3x |

New directors and the Chief Executive Officer are expectedrequired to comply with the ownership requirement within two years and new directors must comply with the ownership requirementrequirements within two years of becoming a member of the Board and all directors are required to hold shares at this level while serving as a director. With respect to executive officers, the Chief Executive Officer is required to own securities of the Company equal in value to at least five times his or her base salary. Each of the Company’s other executive officers is required to own securities of the Company equal to at least three times his or her base salary. The Chief Executive Officer and other new executive officers are expectedrequired to comply with the ownership requirement within two yearsrequirements by January 1st of the year following the fourth anniversary of being so named.

The Nominatingnamed an executive officer. All current directors and Corporateexecutive officers have either met the equity ownership levels of the guidelines or are within the applicable transition period.The Governance Committee may waive the stock ownership requirements in the event of financial hardship or other good cause. Hedging and Pledging of Company Securities .The Company’sInsider Trading Policy prohibits directors and employees, including the executive officers, from hedging their ownership of the Company’s stock, including a prohibition on engaging in the following transactions: (i) trading in call or put options involving the Company’s securities and other derivative securities; (ii) engaging in short sales of the Company’s securities; (iii) holding the Company’s securities in aaccounts that are subject to margin account;calls; (iv) other hedging or monetization transactions related to the Company’s securities, including the use of financial instruments such as prepaid variable forwards, equity swaps, collars and (iv)

| | |

|

| 22 |

exchange funds; and (v) pledging more than 50% of the number of the Company’s securities held individually to secure margin or other loans. Compensation Recovery Policy. In accordance with implementing regulations of the Dodd-Frank Act and associated listing standards, in 2023 the Board adopted an incentive Compensation Recovery Policy that provides for the mandatory recovery of incentive-based compensation from current and former executives that was erroneously awarded during the three years preceding the date that the Company is required to prepare an accounting restatement in which the restated financial reporting measure resulted in a lower incentive award. Refer to Exhibit 97 of the Company's Annual Report on Form 10-K for the year ended December 31, 2023 for a copy of the Company's Compensation Recovery Policy. Board Self-Evaluation . Pursuant to the Company’s Corporate Governance Guidelines and the charters of the Compensation, Audit and Nominating and Corporate Governance Committees of the Board of Directors, the Nominating and Corporate Governance Committee will overseeoversees the annual self-evaluation of the Board and each committee. The self-evaluation requires each director to complete a detailed questionnaire soliciting input on matters such as board structurestructure and composition, committee structure, board and committee meeting conduct, board support, education, and board and committee performance. The Nominating and Corporate Governance Committee reports the assessments to the Board, and if the Board determines that changes in its governance practices need to be made, management and the Nominating and Corporate Governance Committee will work with the Board to implement the necessary changes.

| | |

|

| 23 |

Consideration of Director Nominee

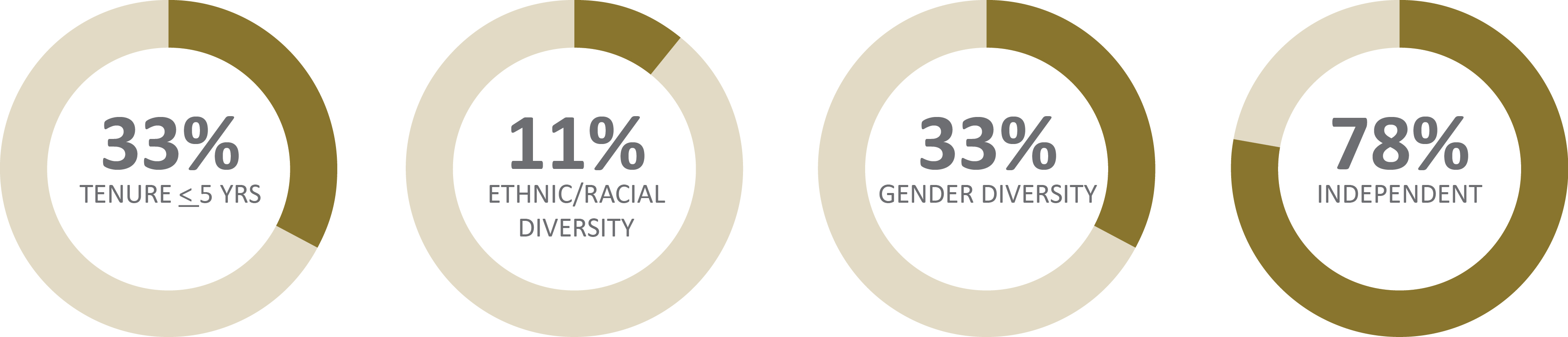

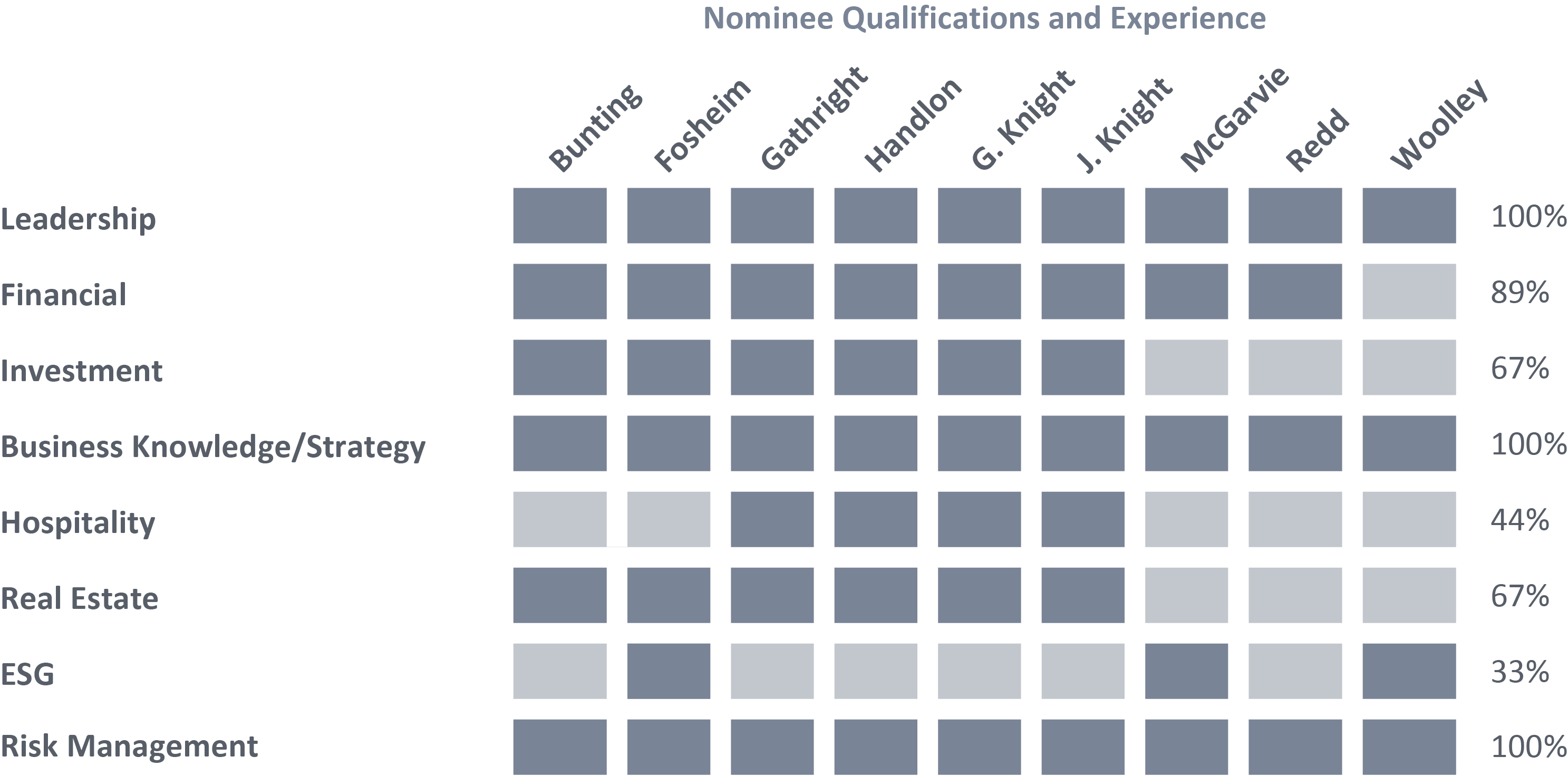

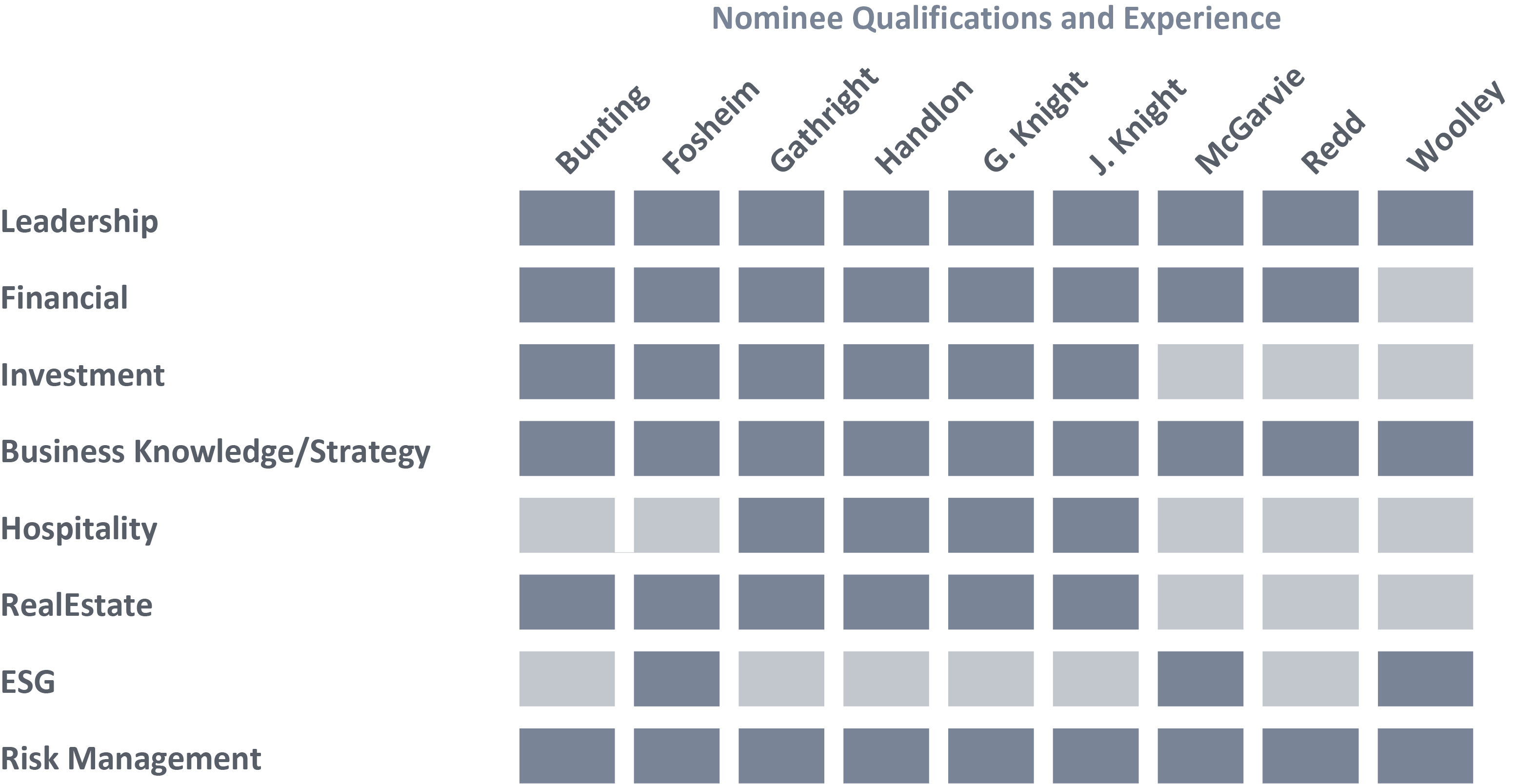

Director Qualifications. The Company believes the Board should encompass a diverse range of talent, skill and expertise sufficient to provide sound and prudent guidance with respect to the Company’s operations and interests. Each director also is expected to exhibit high standards of integrity, practical and mature business judgment, including ability to make independent analytical inquiries, and be willing to devote sufficient time to carrying out their duties and responsibilities effectively.

The Board has determined that the Board of Directors as a whole must have the right mix of characteristics and skills for the optimal functioning of the Board in its oversight of the Company. The Board believes it should be comprised of persons with skills in areas such as finance; real estate; banking; strategic planning; human resources; leadership of business organizations; and legal matters. Although it does not have a diversity policy, the Board believes it is desirable for the Board to be composed of individuals who represent a mix of viewpoints, experiences and backgrounds.

In addition to the targeted skill areas, the Board looks for a strong record of achievement in key knowledge areas that it believes are critical for directors to add value to the Board, including:

Strategy—knowledge of the Company business model, the formulation of corporate strategies, knowledge of key competitors and markets;

Leadership—skills in coaching and working with senior executives and the ability to assist the Chief Executive Officer;

Organizational Issues—understanding of strategy implementation, change management processes, group effectiveness and organizational design;

Relationships—understanding how to interact with investors, accountants, attorneys, management companies, analysts, and communities in which the Company operates;

Functional—understanding of finance matters, financial statements and auditing procedures, technical expertise, legal issues, information technology and marketing; and

Ethics—the ability to identify and raise key ethical issues concerning the activities of the Company and senior management as they affect the business community and society.

Nomination Procedures. The Board has established a Nominating and Corporate Governance Committee that oversees the nomination process and recommends nominees to the Board. As outlined above, in selecting a qualified nominee, the Board considers such factors as it deems appropriate, which may include the current composition of the Board; the range of talents of the nominee that would best complement those already represented on the Board; the extent to which the nominee would diversify the Board; the nominee’s standards of integrity, commitment and independence of thought and judgment; and the need for specialized expertise. Applying these criteria, the Board considers candidates for Board membership suggested by its members, as well as management and shareholders. Shareholders of record may nominate directors in accordance with the Company’s bylaws which require, among other items, notice sent to the Company’s Secretary not less than 60 days prior to a shareholder meeting that will include the election of Board members. No nominations other than those proposed by the Nominating and Corporate Governance Committee were received for the Annual Meeting.

Committees of the Board and Board Leadership

COMMITTEES OF THE BOARD AND BOARD LEADERSHIP Summary. The Board of Directors has four standing committees, which are specified belowbelow. The following table shows each committee’s function, membership and have the following functions:Executive Committee. The Executive Committee has, to the extent permitted by law, all powers vested in the Boardnumber of Directors, except powers specifically withheld from the Executive Committee under the Company’s bylaws or by law.

Audit Committee. The Audit Committee operates in accordance with a written charter that is available at the Company’s website, www.applehospitalityreit.com. The Audit Committee hasmeetings held during 2023:

| | | | | | Executive Committee |

| Number of Meetings During 2023: |

| 0 | Members Glade M. Knight(1) Glenn W. Bunting Jon A. Fosheim Justin G. Knight

| Responsibilities Has all powers vested in the Board of Directors, except powers specifically withheld under the Company’s bylaws or by law.

| Audit Committee |

| Number of Meetings During 2023: |

| 5 | Members L. Hugh Redd(1)(2) Glenn W. Bunting Jon A. Fosheim(2) Carolyn B. Handlon (2)(3)

| Responsibilities Responsibilities are outlined in its written charter that is available at the Company’s website, www.applehospitalityreit.com, and include oversight responsibility relating to the integrity of the Company’s consolidated financial statements and financial reporting processes. The Audit Committee also oversees the Company’s overall risk profile and risk management policies including those related to cybersecurity. A report by the Audit Committee appears in a following section of this Proxy Statement.

| Compensation Committee |

| Number of Meetings During 2023: |

| 2 | Members Glenn W. Bunting(1) L. Hugh Redd Howard Woolley

| Responsibilities Responsibilities are outlined in its written charter that is available at the Company’s website, www.applehospitalityreit.com, and include administration of the Company’s compensation and incentive plans for the Company’s executive officers and oversight of the Company’s compensation practices.

| Nominating and Corporate Governance Committee |

| Number of Meetings During 2023: |

| 3 | Members Blythe J. McGarvie(1) Jon A. Fosheim Howard E. Woolley Carolyn B. Handlon (3)

| Responsibilities Responsibilities are outlined in its written charter that is available at the Company’s website, www.applehospitalityreit.com, and include oversight of all aspects of the Company’s consolidated financial statements and financial reporting processes and has the other functions and responsibilities set forth in its charter. A report by the Audit Committee appears in a following section of this proxy statement.Compensation Committee. The Compensation Committee operates in accordance with a written charter that is available at the Company’s website, www.applehospitalityreit.com, and administers the Company’s compensation and incentive plans of the Company’s executive officers and oversees the compensation practices of the Company.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates in accordance with a written charter that is available at the Company’s website, www.applehospitalityreit.com, and oversees all aspects of the

| | Company’s corporate governance, director compensation, and nominations process for the Board of Directors and its committees. The Governance Committee also reviews the Company’s policies, programs and practices related to corporate responsibility and sustainability, including environmental and related risks, social, human capital and other matters.

|

(1)Indicates the Committee Chair. (2)Indicates Audit Committee Financial Expert. (3)Following her appointment to the Board of Directors on March 1, 2023, Ms. Handlon was appointed to the Audit Committee and Governance Committee, effective March 24, 2023.

| | |

|

| 24 |

Board Leadership. The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board understands that there is no single generally accepted approach to providing Board leadership and the right Board leadership structure may vary as circumstances warrant. Consistent with this understanding, the independent directors periodically consider the Board’s leadership structure. Currently, the roles of chairmanExecutive Chairman and chief executive officerChief Executive Officer are held by different directors. Mr. Glade M. Knight serves as Executive Chairman and Mr. Justin G. Knight serves as President and Chief Executive Officer. The Board believes that this structure provides the appropriate balance between the authority of those who oversee the Company and those who manage it on a day-to-day basis. The Executive Chairman of the Board presides at all meetings of the shareholders and of the Board as a whole. The Executive Chairman performs such other duties, and exercises such powers, as from time to time shall be prescribed in the bylaws or by the Board. Additionally, the Board has appointed Jon A. Fosheim to serve as Lead Independent Director. The Lead Independent Director’s responsibilities include, among other things, presiding at meetings or executive sessions of the independent directors and non-employee directors, serving as a liaison to facilitate communications between the Executive Chairman, the Chief Executive Officer and other members of the Board, without inhibiting direct communications between and among such persons, and serving as a liaison to shareholders who request direct communications and consultations with the Board. Audit Committee Independence . The Board of Directors has determined that each current member of the Audit Committee is “independent,”“independent” as defined in the listing standards of the NYSE. To be considered independent, a member of the Audit Committee must not (other than in his or her capacity as a director or committee member, and subject to certain other limited exceptions) either (a) accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company or any subsidiary; or (b) be an affiliate of the Company or any subsidiary. The Audit Committee currently has twothree members, Mr. Jon A. Fosheim, and Mr. L. Hugh Redd and Carolyn B. Handlon, who are “financial experts” within the meaning of the regulations issued by the Securities and Exchange Commission. The Company’s management believes that the combined experience and capabilities of the Audit Committee members are sufficient for the current and anticipated operations and needs of the Company.In this regard, the Board has determined that each Audit Committee member is “financially literate” and that at least twothree members have “accounting or related financial management expertise,” as all such terms are defined by the rules of the NYSE.Board Meetings,Attendance and Membership Related Information. The Board held a total of 12three meetings during 20152023 (including regularly scheduled and special meetings). The following table shows both the membership of the Company’s standing committees and the number of meetings held during 2015:

Committee | | Members of Committee | | Number of Committee

Meetings During 2015

| Executive | | Glade M. Knight* | | 0 | | | Glenn W. Bunting | | | | | Justin G. Knight | | | | | Bruce H. Matson | | | | | Daryl A. Nickel | | | | | | | | Audit | | L. Hugh Redd* | | 5 | | | Glenn W. Bunting | | | | | Jon A. Fosheim | | | | | | | | Compensation | | Glenn W. Bunting* | | 2 | | | Daryl A. Nickel | | | | | L. Hugh Redd | | | | | | | | Nominating and Corporate Governance | | Bruce H. Matson* | | 3 | | | Jon A. Fosheim | | | | | Daryl A. Nickel | | |

*Indicates the Chair of each committee.

Attendance and Related Information. It is the policy of the Company that directors should attend each annual meeting of shareholders. All of the directors serving at the time of the meeting attended the 20152023 Annual Meeting of shareholders.Meeting. The Company also expects directors to attend each regularly scheduled and special meeting of the Board, but recognizes that, from time to time, other commitments may preclude full attendance. In 2015,2023, each director attended at least 75% of the aggregate of (a) the total number of meetings of the Board of Directors that were held during the period in which he or she was a director, and (b) the total number of meetings held by all committees of the Board on which he or she served during the period in which he or she served.

CompensationExecutive Sessions. The independent members of the Board of Directors meet independently of management and the non-independent directors in executive sessions on a regular basis, presided by the Lead Independent Director. During 2023, the independent members of the Board of Directors met four times.

| | |

|

| 25 |

2023 COMPENSATION OF DIRECTORS The compensation of the directors is reviewed and approved annually by the Board of Directors. During 2015,2023, the directors of the Company were compensated as follows: Reimbursements to Directors in 2015 .2023. All directors were reimbursed by the Company for travel and other out-of-pocket expenses incurred by them to attend the annual shareholder meeting, meetings of the directors and committee meetings and in conducting the business of the Company.Compensation of Independent Non-EmployeeDirectors . In 2015,2023, the independentnon-employee directors (classified by the Company as all directors other than Mr. Glade M. Knight and Mr. Justin G. Knight), received the following directors’ fees: (i) a $140,000compensation in quarterly installments:

| | | | Position Held | 2023 Compensation | | Board of Directors - Annual Retainer (payable in cash) | $ | 70,000 | | Board of Directors - Annual Retainer (payable in Common Shares) | | 115,000 | | Audit Committee Chair (in addition to fees for service on Disclosure Committee) | | 20,000 | | Compensation Committee Chair | | 15,000 | | Nominating and Corporate Governance Committee Chair | | 15,000 | | Lead Independent Director | | 15,000 | |